iowa vehicle tax calculator

Average DMV fees in Iowa on a new-car purchase add up to 354 1 which includes the title registration and plate fees shown above. For example if you purchased a car with a sales price of.

How To File And Pay Sales Tax In Iowa Taxvalet

To calculate the sales tax on a vehicle purchased from a dealership multiply the vehicle purchase price by 625 percent 00625.

. You can calculate the sales tax in Iowa by multiplying the final purchase price by 05. After determining their Iowa state tax liability many Iowa taxpayers must pay a school district surtax. How do you calculate tax title and license on a vehicle in Texas.

Uh oh please fix a few things before moving on. Annual property tax amount. Iowa Tax Proration Calculator.

If you purchased the car. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Iowa Documentation Fees.

Get more tag info on our. Please select a county to continue. By using the Iowa Sales Tax.

If an allowable deduction was limited and added back for Iowa purposes in 2018 because of Iowas lower contribution limitation you may recalculate your Iowa contribution carryforward. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202223. Our calculator has recently been updated to include both the latest Federal Tax Rates.

How to Calculate Iowa Sales Tax on a Car. Maximum Local Sales Tax. You may calculate real estate transfer tax by entering the total amount paid for the property.

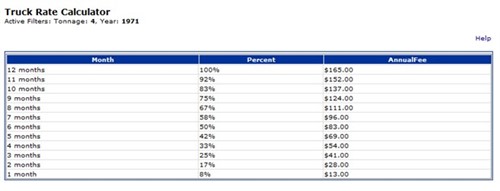

The Iowa Return Proration Federal Tax Paid Vehicle Registration Fee Calculator Tool was created as an aid for obtaining information that may be needed when preparing the Iowa state. Iowa has a 6 statewide sales tax rate but also has. Click Tools then Dealer Inquiry then Fee Estimator on the Iowa State Quote Tool to verify your registration cost and use the MVD Override to adjust the calculator.

Our free online Iowa sales tax calculator calculates exact sales tax by state county city or ZIP code. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price. Iowa State Sales Tax.

For example if the total of state county and local taxes was 8 percent and the. In Iowa the taxable price of your new vehicle will be considered to be 5000 as the. And special taxation districts.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Average Local State Sales Tax. Multiply the sales tax rate by your taxable purchase price.

How do I calculate taxes and fees on a used car. This is equal to a percentage of Iowa taxes paid with rates ranging from. For example lets say that you want to.

Maximum Possible Sales Tax.

Car Tax By State Usa Manual Car Sales Tax Calculator

Iowa Car Registration Fees Are Insanely High And I Don T Think We Talk Enough About It R Iowa

Iowa Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Tax Facts For People With Disabilities Iowa Compass

Electric Vehicles Des Moines Area Mpo

Iowa Car Registration Everything You Need To Know

Breaking Down Iowa Ev Tax Credit Incentives Acura Of Johnston

Property Tax Relief Polk County Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Sales Tax Laws By State Ultimate Guide For Business Owners

Iowa Vehicle Registration And Title Information Vincheck Info

Calculate Your Transfer Fee Credit Iowa Tax And Tags

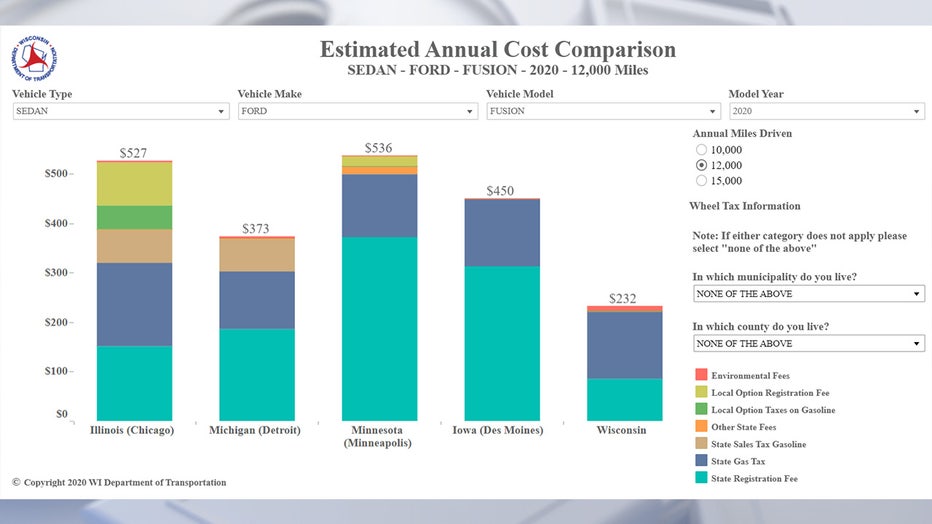

New Tool Helps Motorists Understand What It Costs To Drive In Wi