owner's draw vs salary

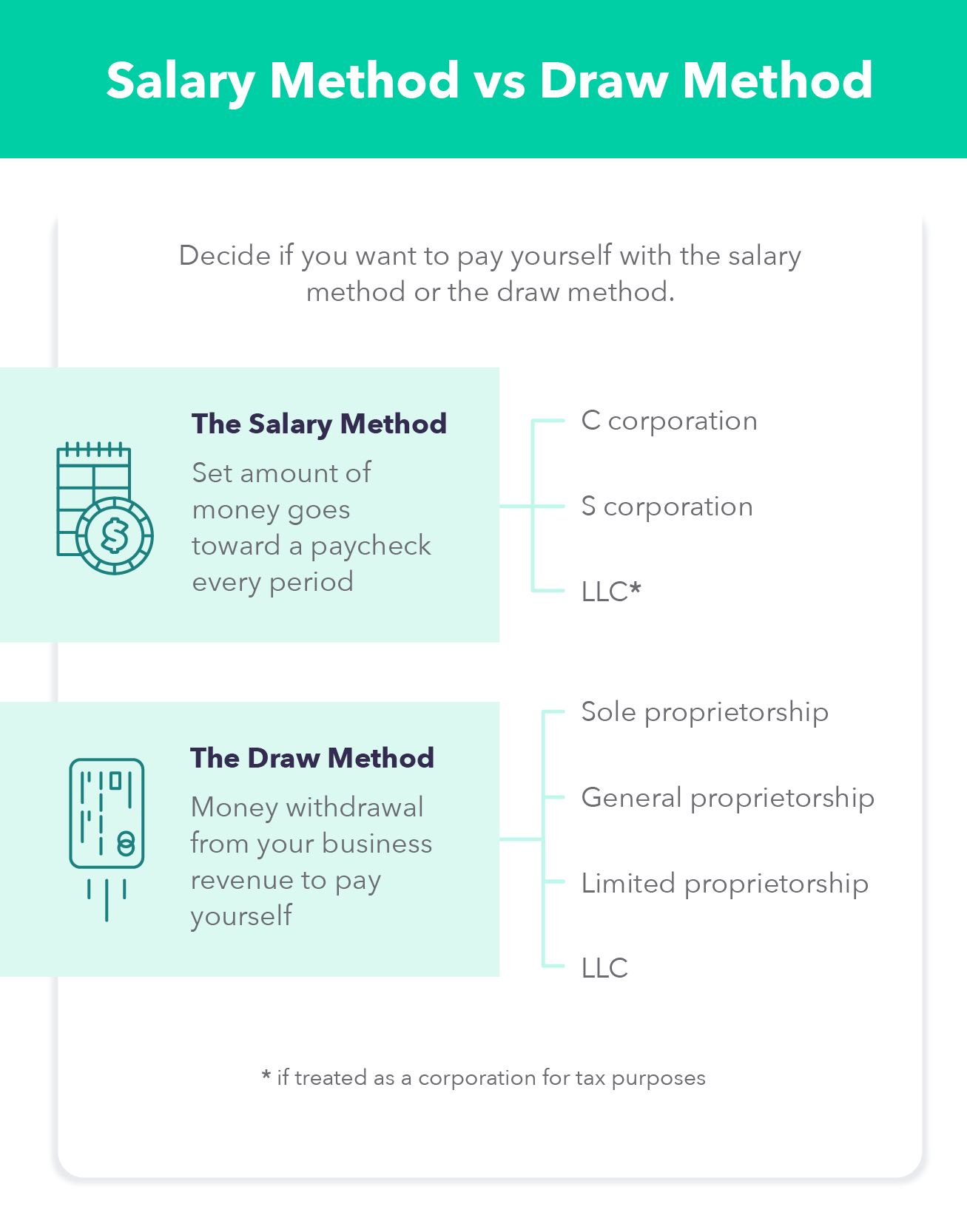

Owners draws can be scheduled at regular intervals or taken only. Your two payment options are the owners draw method and the salary method.

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

70000 contributions 30000 share of profits - 15000 owners draw 85000 partner equity balance.

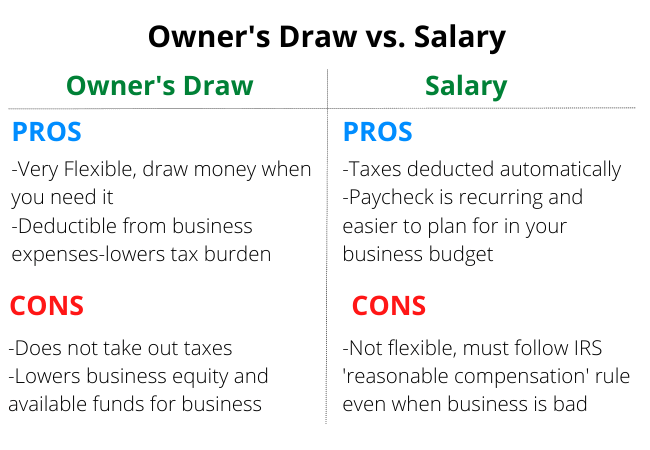

. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. If your company grows. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

Suppose the owner draws 20000 then the. You dont need a salary because you. Owners Draw vs Salary.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. By Toni Cameron On October 17 2019 February 4 2022. Before you can decide which method is best for you you need to understand the basics.

If youre not interested in the bonus route you can always adjust your salary each year based on how your company is performing. However you will be able to take. One method of paying yourself back is receiving a salary.

If you draw 30000 then your owners equity goes down to 45000. The owners draw is the distribution of funds from your equity account. Lump-sum year end bonus.

You can include yourself on payroll along with the rest of your employees and your. Patty can choose to take an owners draw at any time. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Take a look back at the past year and give yourself a bonus that correlates to company growth after break-even. There are two ways to consider how to pay yourself and they are either the owners draw or a salary.

Here is her partner equity balance after these transactions. Taking Money Out of an S-Corp. Before you can decide which method is best for you you need to understand the basics.

Also you cannot deduct. Understand the difference between salary vs. In the former you draw money from your business as and when you see fit.

Before you make the owners draw vs. Taking Money Out of an S-Corp. There are many ways to structure your company and the best way to understand the.

Both have their pros and cons and heres a look at the owners. If an individual invests 30000 into a business entity and their share of profit is 18000 then their owners equity is at 48000. Also you can deduct your pay from business profits as an expense which lowers your tax burden.

However it can reduce the businesss. An owners draw is very flexible. This leads to a reduction in your total share in the business.

So if your company grew by 50 in the past. She could choose to take some or even all of her 80000 owners equity balance out of the business and the draw. Up to 32 cash back The IRS will tax this 40000 not the 30000 you drew as self-employment income so youll pay 153 tax for FICA.

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. Is it a draw or a. Understand the difference between salary vs.

Salary decision you need to form your business.

Vigilant Eye On Gender Pay Gap Published 2014 Gender Pay Gap Wage Gap Gender Equality Poster

Should I Take An Owner S Draw Or Salary In An S Corp Hourly Inc

Salary Payyourself Selfemployed Smallbusiness Taxes Salary Business Performance Profitable Business

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Business Budget Template Business Expense Small Business Expenses

Entrepreneur Salary 5 Steps To Paying Yourself First Mintlife Blog

Owner Draw Vs Salary Paying Yourself As An Employer

Owner S Draw Vs Payroll Salary Paying Yourself As An Owner With Hector Garcia Quickbooks Payroll Youtube

Chi Square Test In Excel Step By Step With Examples Chi Square Research Methods Null Hypothesis

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner

Are You New To Tracking Reviewing And Reporting Your Business S Finances Find Out How To Set Up Accounting B Accounting Books Accounting Accounting Training

Frequency Distribution Dashboard Solution Metrics Dashboard Dashboard Solutions

Whitepaper Interactive Content Strategy For Ecommerce Businesses Content Strategy Whitepaper Interactive

Men Vs Women Men Vs Women Man Vs Infographic

Conflict Theory Theories Financial Management Conflicted

The Real Income Money And Workload Between Ceo Business Owner And Office Employee Staff What Is Your Next Mo Cartoons Vector Character Design Cartoon People

Why Art V 2 Elementary School Students Elementary Schools How To Make Image

Easy Monthly Budget Template Wendy Valencia Monthly Budget Template Budget Template Saving Money Quotes